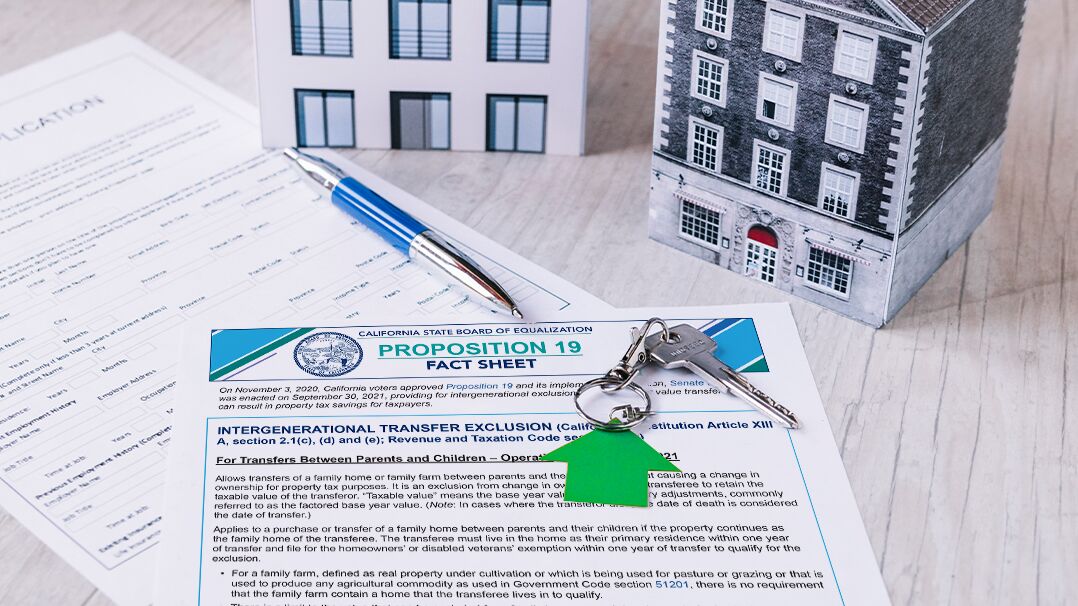

Navigating the ever-evolving landscape of real estate regulations can be a daunting task, especially for home sellers in California. This year, Proposition 19 has become a topic of significant importance, sparking both curiosity and concern.

The implications for homeowners grappling with the decision to sell their properties are multi-faceted and require careful deliberation. Understanding the intricacies of Prop 19 is essential to ensure a smooth and successful home-selling process.

From tax implications to eligibility criteria, this article delves into the nuanced aspects of Prop 19 and provides comprehensive guidance for homeowners in California. Whether you are a seasoned seller or contemplating your first venture into the real estate market, this article aims to shed light on the intricacies of Prop 19 and equip you with valuable insights to make informed decisions.

Exploring the Impact of Proposition 19 on Home Sellers: Key Considerations

Exploring the Impact of Proposition 19 on Home Sellers: Key ConsiderationsIn the midst of California’s evolving real estate landscape, Proposition 19 has emerged as a significant force reshaping the dynamics for home sellers across the state. This groundbreaking proposition introduces a range of considerations that sellers need to navigate to ensure a smooth transaction process.

With its implications spanning from reassessment exclusions to property tax transfers, understanding the intricacies of Prop 19 becomes paramount for sellers looking to seize new opportunities and mitigate potential setbacks. This article unravels the complexities of Proposition 19 and sheds light on key considerations for home sellers, empowering them to make informed decisions in an ever-changing market.

Navigating Proposition 19: How Home Sellers in California are Affected

Navigating Proposition 19: How Home Sellers in California are AffectedAs the dust settles over the recent passing of Prop 19, homeowners in California find themselves grappling with its implications. This game-changing proposition has undoubtedly stirred up the real estate market, leaving home sellers in a state of uncertainty.

With its intricate provisions and far-reaching consequences, understanding how Proposition 19 impacts home sellers is paramount. From tax implications to familial transfers and reassessment rules, the intricate web of changes demands careful navigation.

Delving into the nuances of Prop 19, sellers are confronted with a myriad of considerations that go beyond a straightforward transaction. Brace yourself for a complex journey through the real estate landscape as we explore the multifaceted implications of Proposition 19 for homeowners intending to sell their properties in the Golden State.

Proposition 19 Effects on Property Taxes: Insights for Home Sellers

Proposition 19, a significant legislation in California, has sparked immense curiosity among home sellers regarding its influence on property taxes. Understanding the intricate nuances of this proposition is crucial for navigating through potential changes and making informed decisions.

With Prop 19, there are both potential advantages and disadvantages for homeowners, particularly when it comes to property taxes. Home sellers must grasp the implications of this proposition to ensure they are well-prepared for any forthcoming alterations in the real estate market.

By gaining insights into how Prop 19 may impact property taxes, homeowners can strategically adapt their selling strategies and make the most out of their investments.

Proposition 19 Impact on Inheritance Transfers: What Home Sellers Need to Know

Proposition 19 has brought significant changes to the California real estate landscape, particularly about inheritance transfers. In this article, we aim to shed light on what home sellers need to know about the impact of Prop 19 on these transfers.

With its implementation, the process of passing down properties to loved ones has become more intricate, necessitating a comprehensive understanding of the new regulations. As homeowners embark on the journey of selling their homes, it is crucial to navigate the complexities introduced by Prop 19 and ensure compliance to maximize the benefits while minimizing potential pitfalls.

Here, we delve into the key aspects that home sellers in California must be aware of to effectively navigate this transformed landscape and make well-informed decisions for their inheritance transfers.

Conclusion

In conclusion, the passing of Proposition 19 in California brings forth several implications for home sellers. With the elimination of certain tax benefits and the implementation of new regulations, sellers must navigate these changes carefully.

However, amidst the complexities, there are still opportunities for homeowners to optimize their real estate transactions. Seeking the guidance of experienced professionals and resources like https://gordonbuyshomes.com/we-buy-houses-california/ can provide valuable insights and assistance in understanding the intricacies of Proposition 19, ultimately helping sellers make informed decisions. By staying informed and adapting to these new regulations, homeowners can effectively navigate the changing landscape of California’s real estate market and achieve successful sales.